ESG SOLUTION

AI for sustainable finance

Capital markets are rapidly moving to acknowledge, understand & incorporate Environmental, Social, and Governance factors

But translating this into reliable action is compromised as ESG data is often noisy and unreliable

50%

46%

Of asset managers see a lack of forward-looking disclosure as limiting the value of ESG reporting

View the lack of real-time information as a limitation on the value of ESG data

Access to and deployment of data remains the biggest challenge for asset managers who want to present an accurate ESG perspective

Ratings agencies add to the uncertainty gap with opaque practices and conflicting messages

There is only a 0.61 correlation across leading agencies’ ESG ratings

Rating agencies' ESG engines are often a black box:

Limited info on what data/criteria is included

Lack of explanation as to how data is weighted in final ratings

Rating valuation models often do not fit investment valuation models

Capital market participants struggle to get the guidance and value they need for investors from the available ratings

62

up to 10

different third-party vendors to cover their ESG data needs.

of the largest asset managers worldwide use.

Further confusion as even Regulators provide very limited ESG frameworks

Asset managers & Investment banks further impacted as authorities can still impose fines if a firm claims to deliver ESG quality reviews without scientific proof/evidence

ASSESSING ESG DATA IN ISOLATION CAN BE

EVEN MORE OF A CHALLENGE

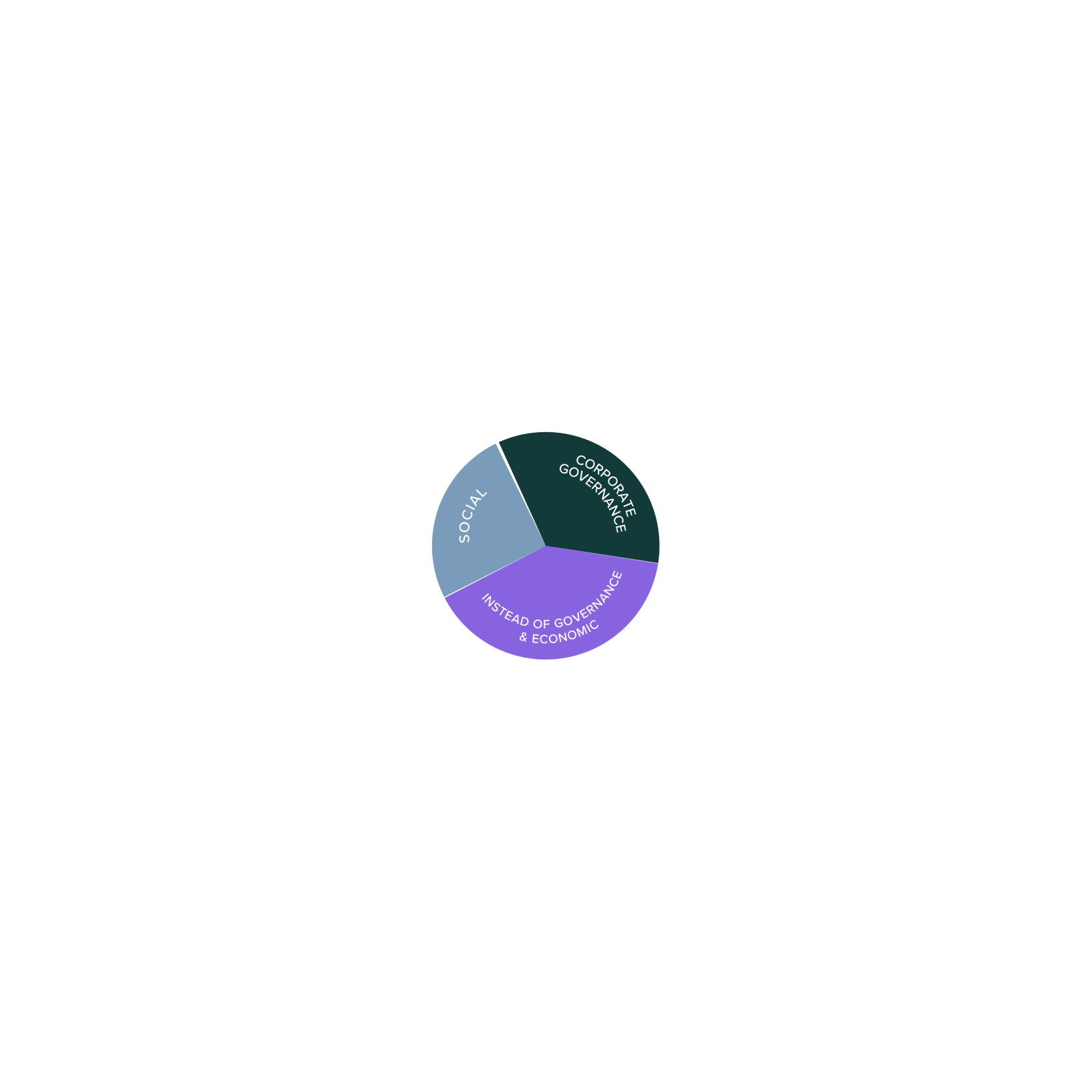

ESG data is intrinsically qualitative, so dealing with ESG assessment requires analyzing data on different levels. Those data sets also need to be considered in an integrated and holistic way to deliver value.

Lack access to all required data infrastructure to realize the potential of all data sources

Structured Quantitative data

Lack open data integration which further undermines clarity

Semi-Structured data

Require enormous amounts of data to be processed for continuous and relevant analysis

Unstructured data

Need access to the high complexity of AI/ML model management to be able to fully leverage AI technology

Lack a real-time operating environment

Qualitative data

Have challenges with inevitable increases in operational costs

To gain a competitive advantage asset managers need a holistic, integrated and real-time ESG data solution that can access and leverage data not currently available from existing providers. They also need information customized to individual corporate business value models and an auditable trail of its sources for regulatory compliance justification

THE ESG DATA PlATFORM SOLUTION INTEGRATES DATA

from diverse sources

Statistics

Data

aggregators

SatelLite images

Press release

Social media

Ecological reports

It should be able to:

Process up to 1.3TB of ESG data daily

Quantify qualitative data

Read structured & unstructured info

Measure against agreed benchmarks

ESG DATA PLATFORM

Filter noise to focus on quality

Provide auditable trail

The world wide web universe

100 000+

Data points

That impact your business

1 000+

3

Filters

Essential scores

Clearing the noise

1

500+

Valuation factor

Criteria

As per your selection

The world wide web universe

100 000+

Data points

That impact your business

1 000+

Filters

Clearing the noise

500+

Criteria

As per your selection

3

Essential scores

1

Valuation factor